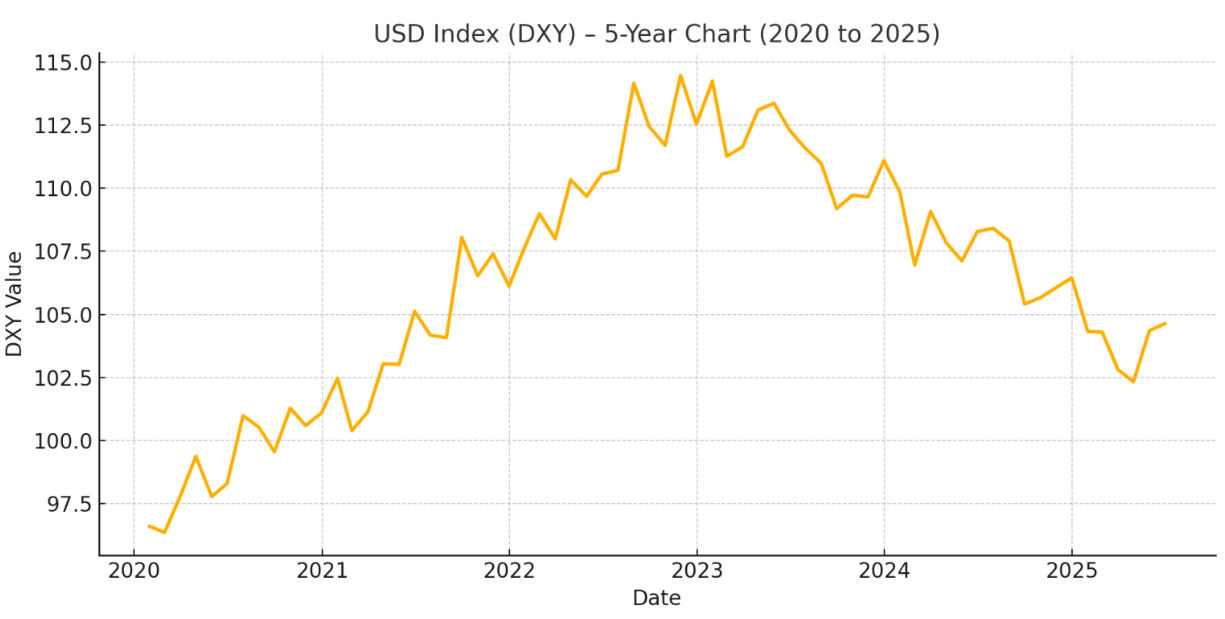

Dollar exchange rate forecast 2025: will it rise by the end of the year?

In 2025, the US dollar is weakening slightly, but may rise slightly by the end of the year. The DXY is currently hovering around 98.4. Support is at 96.5-97.0.

The main thing that can help the dollar is if the Fed (the US central bank) slows down its rate cuts or people start buying the dollar as a safe asset again.

Where is the dollar now: a brief overview for November 2025

In early November, the dollar strengthened slightly after hitting September lows. The DXY rose from 96.8 to 98.4. The market is waiting for new data from the Fed. The chances of another 0.25% rate cut have become less likely as the US economy is growing and inflation is still above 2%.

This month's important events are the jobs report (NFP) and inflation data (CPI). They will determine what the Fed will decide in December.

Politics, budget delays, and the threat of new tariffs keep investors on edge. Money is flowing into gold, European assets, and the debts of developing countries. For example, the dollar is about 83.5 against the Indian rupee and about 150 against the yen.

Why the dollar is falling in 2025

Since the beginning of the year, the dollar has lost 4-5%. This is the worst start since 2020. In the first half of the year, it fell by 10.7% against a basket of major currencies.

The reasons are simple:

1. Political instability. The new Trump administration promised tariffs and tax changes. Initially, this boosted the dollar, but investors lost confidence due to inconsistencies.

2. Money comes from the dollar. Many funds are holding the fewest dollars since 2005. People are buying gold, the Swiss franc, the yen, and emerging market debt.

3. Rates in other countries. The Fed plans only one rate cut in the fourth quarter. The ECB plans two, the Bank of England - three. Japan may even raise rates. This is why the dollar is losing its advantage.

If you're looking for a reliable place to check current rates and make quick exchanges, Namomenti is the perfect choice. It always has the most up-to-date exchange rates with a convenient online currency exchange.

Technical review

The DXY is holding above 96.5. Resistance is at 99.5-100.0. The dollar is slightly overvalued, but its foundation - its status as the world's reserve currency - is solid.

When the dollar may rise

Chances for growth are at the end of the year. This will happen if:

- inflation will be higher than expected;

- The Fed will stop cutting rates;

- the world will start to fear risks again.

Keep an eye on November's inflation and jobs data, the December Fed meeting, and possible year-end shocks.

Is it worth buying the dollar now

Compared to the peaks of 2024, the dollar looks favorable.

- For importers - fix the rate before a strong fluctuation begins.

- For exporters - Keep your prices flexible.

- For investors - A weak dollar boosts profits from foreign assets.

- For travelers - is a good time to buy dollars for travel.

GBP/USD: why the pound is growing

The pound hit a 40-month high in June, not because of Britain's strength but because of the dollar's weakness. The expected exchange rate for the fourth quarter is about 1.30 (range 1.26-1.33). It is now profitable to buy dollars to make payments abroad or buy real estate.

Forecast by quarters

Quarter | What to expect | DXY range | Explanation |

III 2025 | Moving sideways or downward | 97–99 | We are waiting for the Fed's decision |

IV 2025 | Slightly weaker | 96–99 | Lower rates will restrain growth |

2025 in total | Below average | ~98 | Politics puts pressure on the exchange rate |

The dollar is preparing for revenge

The USD remains the world's base currency. Politics and money outflows are putting pressure in the short term, but the fundamentals are solid.

If the Fed is cautious, 2026 could be the year the dollar returns to strength - but without any sharp jumps.

Source:Cambridge Currencies – USD Forecast 2025

Recommended:

How to buy cryptocurrency

Bitcoin price forecast to $100,000

Changpeng Zhao's wealth increased by $3 billion during his imprisonment...

Why the US Federal Reserve rate decides the fate of Bitcoin and altcoins...

SWIFT changes the rules of the game: what awaits cryptocurrencies...

Revenues from Ethereum staking fell by 42% in half a ...

What is Ethena Finance? The essence of the synthetic dollar U...

The Hamster Kombat team has announced that the second season of ...

In 4 years, the largest inflow of institutional...

Ripple CEO predicts a reboot of the crypto industry...

The US Treasury wants to reduce the market of private equity...

Bitcoin has updated its historical maximum after the decision of the F...

Bitcoin rate soars: US authorities will buy up to 5% of B...

Europe cradles the Bitcoin rate: the pension fund of the Great...

Analyst Michael van de Popp predicts Bitcoin will reach $100...

Will Trump's victory affect Bitcoin's price?

Analyzing pumps in the cryptocurrency market

Ethereum ecosystem: preparing for a new breakthrough

Solana vs. Ethereum: who will win in the fight for De...

Cryptocurrency trends in 2024: what to look for...

CBDC: how digital currencies of central banks will change...

Bitcoin Jesus scandal: what happened to Roger...

Development of the cryptocurrency industry in Ukraine

$

USD₴

UAH

+38 (067) 450 40 40

+38 (067) 450 40 40