Why will precious metals prices remain high until 2026?

Precious metals, in particular gold, silver and platinum, remain one of the most reliable assets for investors in times of economic uncertainty. Forecasts indicate that their prices will remain high through 2026 as global economic factors, growing demand and tight supplies continue to support this trend.

Why are precious metals rising in price?

- Economic factors: The COVID-19 pandemic, political crises, and lower interest rates are creating uncertainty in financial markets. This leads to increased demand for gold and silver as a hedge against inflation and currency risks.

- Technological demand: Silver and platinum are actively used in industry and new technologies, such as renewable energy (solar panels, hydrogen technologies), which increases their value.

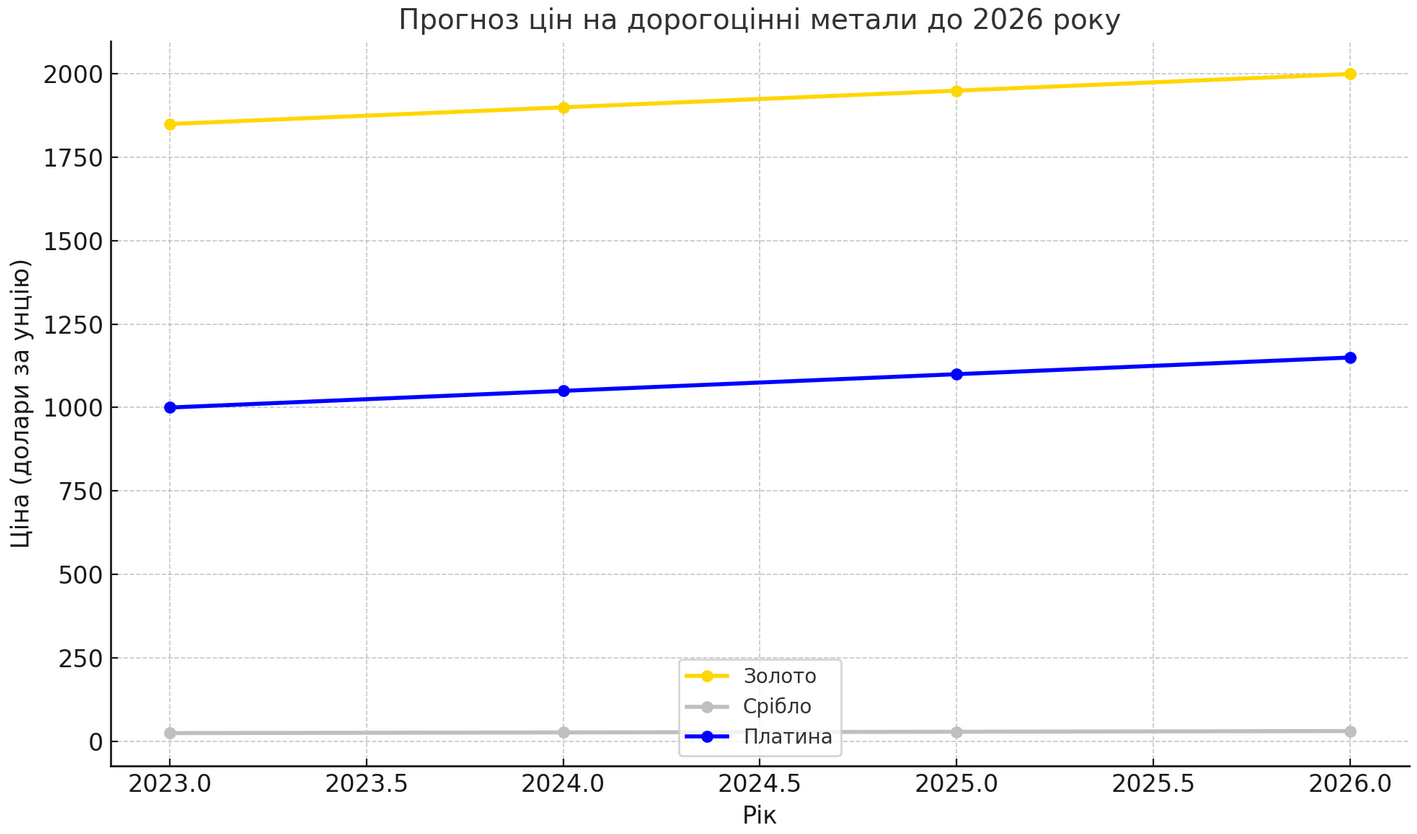

Forecasts until 2026

Precious metals prices are expected to remain high due to several key factors:

- Inflation: Forecasts show that inflation will remain high, which will increase the attractiveness of metals as assets for preserving value.

- Technology and energy: Rising demand for silver and platinum in industries such as renewable energy and electronics will drive their further growth.

- Uncertainty in the economy: Political and economic crises continue to push investors to precious metals as a way to protect themselves from risks.

Is it worth investing in precious metals?

Investments in precious metals remain relevant, especially in the context of global economic instability.

Gold has traditionally been a reliable asset for long-term investors, as it retains its value in times of economic crises.

Silver and platinum may be attractive to investors looking for greater upside potential through their use in technological and environmental innovation.

If you want to add gold or silver to your investment portfolio, you can buy these metals on favorable terms.

How to buy precious metals?

- Physical metals: Buying bullion or coins is a classic investment method that allows you to store assets in real physical form.

- Financial instruments: ETFs or shares of companies involved in metal mining allow you to invest without having to store physical metals.

- Futures contracts: For experienced investors who want to make money from price fluctuations, futures contracts may be of interest.

Results and recommendations for investors

Until 2026, precious metals will continue to be attractive assets for investors due to a number of economic and technological factors. If you are planning to invest in gold, silver or platinum, you should take a long-term view, as their prices are likely to rise due to continued demand and market stability.

Recommended:

How to buy cryptocurrency

Bitcoin price forecast to $100,000

Changpeng Zhao's wealth increased by $3 billion during his imprisonment...

Why the US Federal Reserve rate decides the fate of Bitcoin and altcoins...

SWIFT changes the rules of the game: what awaits cryptocurrencies...

Revenues from Ethereum staking fell by 42% in half a ...

What is Ethena Finance? The essence of the synthetic dollar U...

The Hamster Kombat team has announced that the second season of ...

In 4 years, the largest inflow of institutional...

Ripple CEO predicts a reboot of the crypto industry...

The US Treasury wants to reduce the market of private equity...

Bitcoin has updated its historical maximum after the decision of the F...

Bitcoin rate soars: US authorities will buy up to 5% of B...

Europe cradles the Bitcoin rate: the pension fund of the Great...

Analyst Michael van de Popp predicts Bitcoin will reach $100...

Will Trump's victory affect Bitcoin's price?

Analyzing pumps in the cryptocurrency market

Ethereum ecosystem: preparing for a new breakthrough

Solana vs. Ethereum: who will win in the fight for De...

Cryptocurrency trends in 2024: what to look for...

CBDC: how digital currencies of central banks will change...

Bitcoin Jesus scandal: what happened to Roger...

Development of the cryptocurrency industry in Ukraine

$

USD₴

UAH

+38 (067) 450 40 40

+38 (067) 450 40 40