Crypto Industry Overview 2025: Key Trends and Market Analysis

In 2025, the cryptocurrency market experienced significant fluctuations, ending the year with a decline in total capitalization, but with strong progress in the stablecoin and derivatives segments.

This analysis is based on data from CoinGecko and takes into account the impact of macroeconomic factors, from monetary policy to geopolitical events.

Cryptocurrency market capitalization in 2025: a 10% drop

The market was highly volatile, leading to the first annual decline since 2022. The largest decline occurred in the fourth quarter due to external shocks, including the announcement of large-scale duties, which led to mass liquidations.

The maximum capitalization reached $4.4 trillion in the middle of the year, but by the end of December the market stabilized at $3.0 trillion. The average daily trading volume peaked in $161.8 billionThis indicates that traders are more active during sharp market movements.

One of the key triggers of the correction was the record liquidation on October 10, 2025, worth about $19 billion, which significantly increased pressure on the market.

Bitcoin: correction, records and institutional interest

Bitcoin, as the main asset of the market, ended the year in the red zone, although it reached new historical highs during the period. This result was a marked contrast to previous growth cycles.

The price of BTC decreased by 6,4% for the year, while the market experienced a short-term peak in August and a serious correction after the October events. Despite this, the institutional presence remained strong, with digital asset companies (DATCos) accumulating more than 1 million BTC, which is more than 5% of the total supply.

This approach emphasizes the long-term belief in bitcoin as a strategic reserve, even amid short-term pressure.

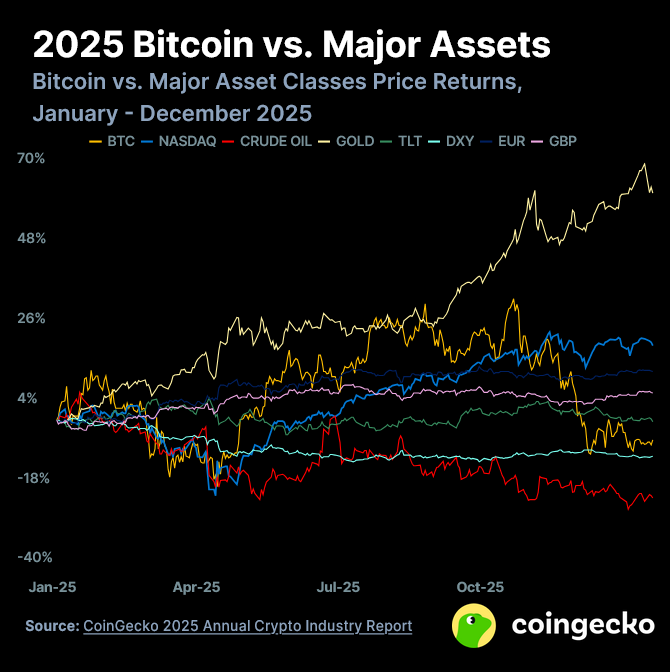

Traditional assets vs. crypto: gold and NASDAQ growth

Traditional assets significantly outperformed crypto in 2025, demonstrating a clear divergence of trajectories. This is due to the global demand for protective instruments in times of uncertainty.

In 2025, gold rose by 62,6% due to active purchases by central banks, and the NASDAQ index added 20.5% on the back of the tech boom. At the same time, bitcoin ended the year down 6.4%, alongside the US dollar and oil, which also showed negative dynamics.

These figures explain why many investors began to diversify their portfolios more actively in 2025, combining crypto with classic instruments.

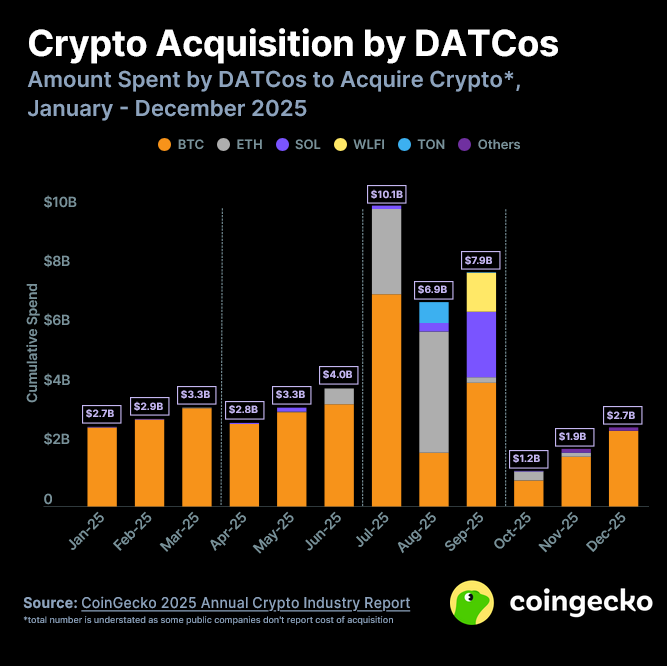

Companies with digital assets: the role of institutional investors

Institutional players have significantly strengthened their positions in crypto despite price fluctuations. Their activity has become one of the market's stabilizing factors.

The total amount of investments reached $49.7 billionwith half of it occurring in the third quarter during a relatively optimistic mood. At the beginning of 2026, their crypto assets reached $134 billion, including more than 1 million BTC and significant amounts of ETH.

The fourth quarter was particularly revealing, when companies moved to aggressive buybacks of shares and assets in the fall, which demonstrates strategic thinking.

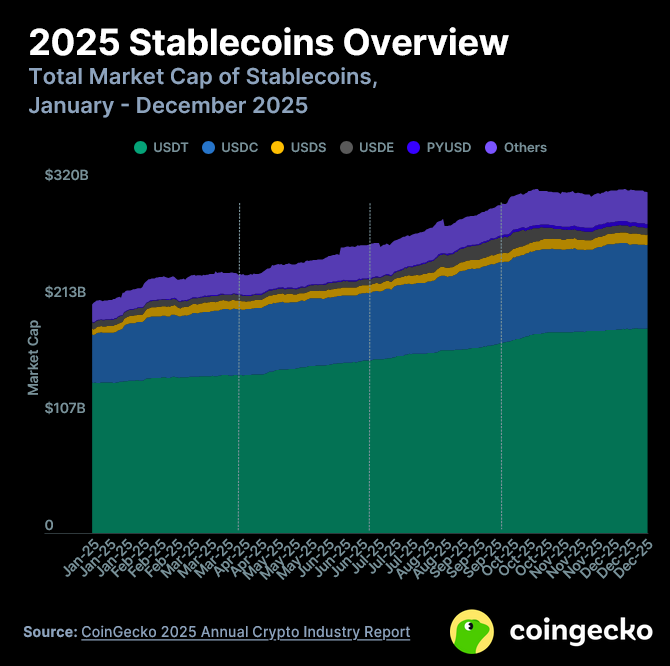

Stablecoins: record capitalization and key risks

Stablecoins have cemented their status as the most stable and fastest growing segment, providing liquidity and capital protection in the face of volatility.

Capitalization updated the historical record, thanks to integrations into traditional finance and revenue products. For example, PYUSD from PayPal increased by 48.4% to $3.6 billion, while USDe from Ethena lost 57.3% due to deviations from the peg.

These cases illustrate both opportunities and risks in the stablecoin segment.

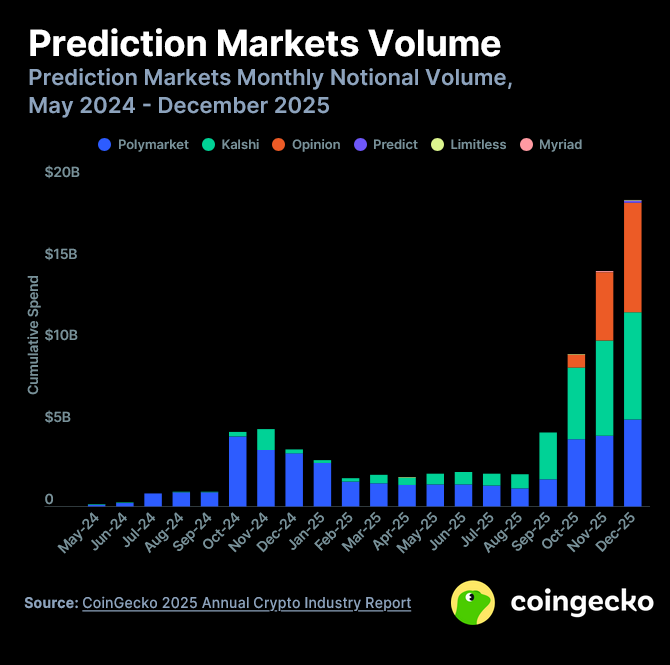

Prediction markets: one of the most dynamic segments of the crypto market

Prediction markets have become one of the fastest growing areas, attracting users with the opportunity to bet on real events.

Trade volume grew from $15.8 billion in 2024 to $63.5 billion, which confirms a sharp recovery in the market. At the beginning of the year, the market was dominated by Polymarket, while in the fourth quarter Kalshi strengthened its position by taking 39,6% market.

The platform stands out separately Opinion on BNB Chainwhich reached a trading volume of about $7 billion in December thanks to a reward system, demonstrating the growing appeal of decentralized solutions.

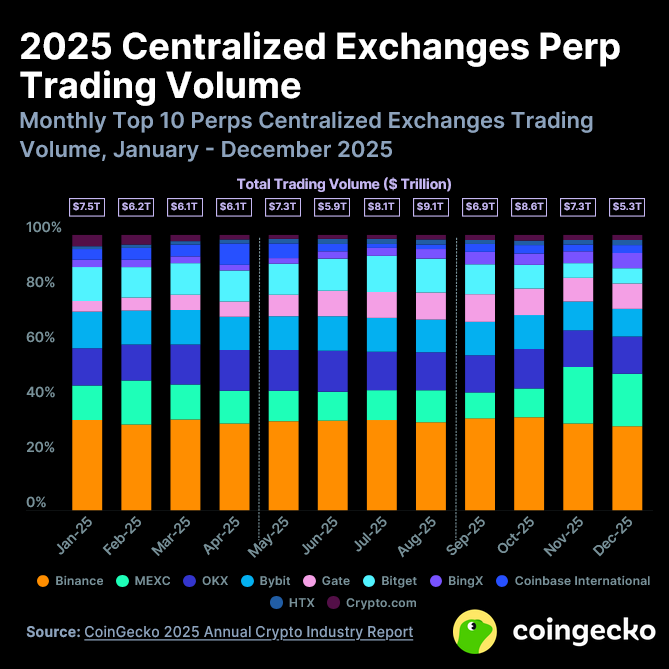

Perpetual contracts on centralized exchanges: record volumes

Perpetual contracts on centralized exchanges retained their leadership in terms of volume and liquidity despite all the market turmoil.

Total turnover reached a historic high of $86.2 trillion, peaking in October. MEXC came in second, overtaking OKX and Bybit, and KuCoin exceeded $1 trillion. These dynamics emphasize the resilience of the top platforms and the intensification of competition.

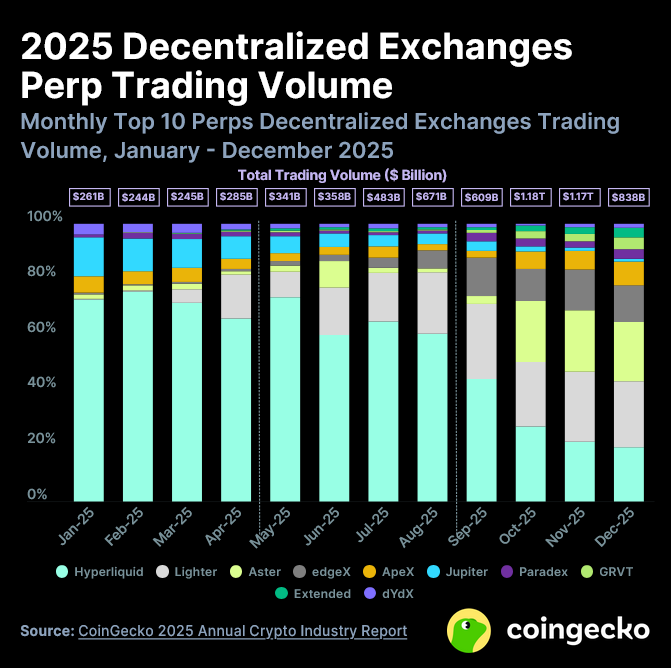

Perpetual contracts on decentralized exchanges: the DEX boom

Decentralized cryptocurrencies have experienced a real boom, attracting attention through transparency and incentive programs.

The top 10 DEX reached $6.7 trillionwith a sharp acceleration in the fourth quarter (+80.8%). The share of DEX in CEX increased to 7.8%. The leaders were Hyperliquid, Lighter and Asterwhere volumes reached $2.9 trillion, largely driven by airdrops and liquidity fees.

Transition to a mature crypto economy: results of 2025

The results of 2025 show that the crypto market is gradually moving beyond hype cycles. Despite the decline in capitalization and high volatility, the industry has demonstrated resilience and the ability to adapt to external obstacles. The growing role of stablecoins, the activity of institutional players, and record volumes in derivatives indicate Strengthening the financial infrastructure.

New areas such as forecasting markets and decentralized perpetual contracts have shown rapid growth and liquidity attraction, shifting the focus from speculation to practical use.

Overall, CoinGecko's 2025 report confirms that the institutional framework is getting stronger, the infrastructure is scaling, and the crypto economy is entering a phase of systemic development. That is why 2025 went down in history as the moment when the crypto market finally ceased to be a niche experiment.

Source: CoinGecko

Recommended:

How to buy cryptocurrency

Bitcoin price forecast to $100,000

Changpeng Zhao's wealth increased by $3 billion during his imprisonment...

Why the US Federal Reserve rate decides the fate of Bitcoin and altcoins...

SWIFT changes the rules of the game: what awaits cryptocurrencies...

Revenues from Ethereum staking fell by 42% in half a ...

What is Ethena Finance? The essence of the synthetic dollar U...

The Hamster Kombat team has announced that the second season of ...

In 4 years, the largest inflow of institutional...

Ripple CEO predicts a reboot of the crypto industry...

The US Treasury wants to reduce the market of private equity...

Bitcoin has updated its historical maximum after the decision of the F...

Bitcoin rate soars: US authorities will buy up to 5% of B...

Europe cradles the Bitcoin rate: the pension fund of the Great...

Analyst Michael van de Popp predicts Bitcoin will reach $100...

Will Trump's victory affect Bitcoin's price?

Analyzing pumps in the cryptocurrency market

Ethereum ecosystem: preparing for a new breakthrough

Solana vs. Ethereum: who will win in the fight for De...

Cryptocurrency trends in 2024: what to look for...

CBDC: how digital currencies of central banks will change...

Bitcoin Jesus scandal: what happened to Roger...

Development of the cryptocurrency industry in Ukraine

$

USD₴

UAH

+38 (067) 450 40 40

+38 (067) 450 40 40