Silver Price in 2026: Could Silver Outperform Gold and Become the Cycle's Top Asset?

As of January 23, 2026, the spot price of silver fluctuates between 98-99 dollars per troy ounce (31.1 g). This is almost three times higher than at the beginning of 2025 and one of the strongest annual movements in recent decades.

In Ukraine, according to the official data of the National Bank of Ukraine, the estimated silver price is close to UAH 4070,4100-130,999 per ounce, or about UAH {{4}} per gram of pure metal ({{5}}). It is important to keep in mind that physical silver at banks and dealers is sold at a premium, which can vary significantly depending on the form (bars, coins) and demand.

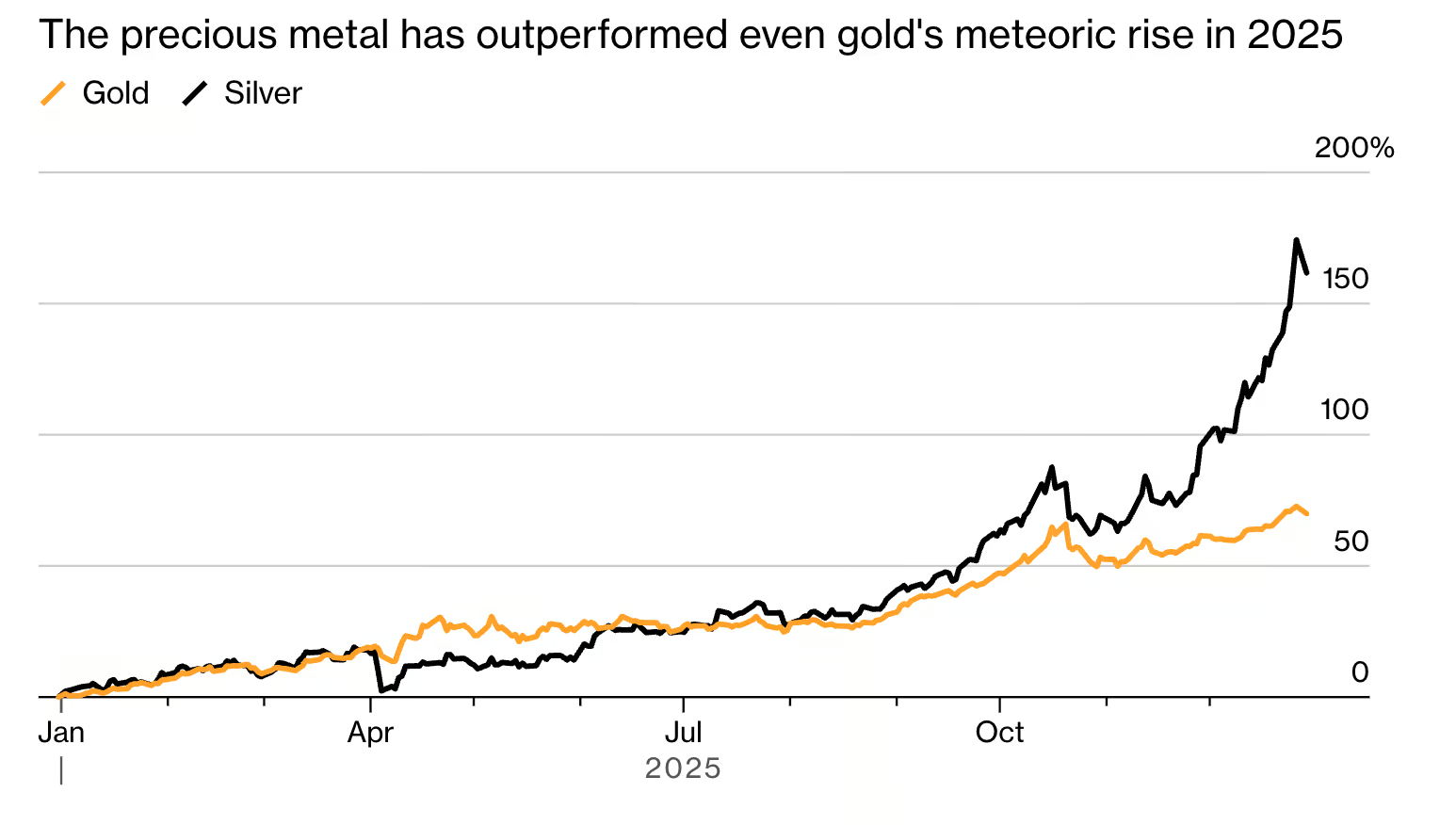

The dynamics of growth over the past year are well illustrated by charts from financial platforms such as Dukascopy and Investing News, which show that the market has not formed a short "surge" but a steady upward trend with periods of consolidation.

Why the price of silver rose so sharply in 2025-2026

Graph illustrating the percentage increase in the price of silver and gold in 2025

Unlike gold, silver is a double assetIt is both a defense tool and a key industrial raw material. According to industry analysts, about 50-60% of the total global demand for silver comes from industry.

The key growth factors are as follows:

- Solar energy - is the biggest driver of demand. Silver is used as a highly efficient conductor in photovoltaic cells, and even a decrease in its share in panels will not compensate for the overall growth in production.

- Electric vehicles, electronics and data centers - Modern EVs and AI infrastructure consume significantly more silver than traditional technologies.

- Supply shortage - For several years in a row, silver production has not kept pace with demand. Much of the metal is mined as a by-product, so it is almost impossible to increase production quickly.

- Geopolitical tensions and a weaker dollar - In times of uncertainty, investors are more active in real assets, and silver becomes a more affordable alternative to gold.

As a result, the market has entered a phase where demand is structural rather than dependent on speculative expectations.

Could silver outperform gold in 2026?

In 2025, silver will already outperformed gold in terms of percentage growthand in 2026 this topic became the subject of active discussions among analysts. It is not about the absolute price, but about the dynamics and growth potential.

There are several reasons why silver has a chance to perform better again:

- strong and stable industrial demand (solar energy, EVs, AI);

- a possible easing of the Fed's monetary policy, which traditionally supports precious metals;

- chronic shortage of silver in the physical market.

At the same time, silver is much more volatile than gold. If the global economy slows down sharply and industrial sectors cut back on purchases, the price could adjust faster and deeper.

Most forecasts for 2026 converge on a wide range of 80-120 dollars per ouncewhile optimistic scenarios allow for a consolidation above $100 if the deficit persists.

How to invest in silver in 2026: practical options

Several basic investment formats are available for Ukrainian investors:

- Physical silver - bars and investment coins (e.g., American Silver Eagle or Canadian Maple Leaf). It is suitable for long-term storage, but comes at a premium and requires secure storage.

- Exchange traded funds (ETFs) - allow you to invest in silver without physical possession of the metal and with high liquidity.

- Shares of mining companies - the riskiest option, but with potentially higher returns during periods of price growth.

The choice of instrument depends on the investment horizon and risk appetite.

Risks and practical advice for 2026

Despite the strong trend, silver remains a volatile asset. It can grow rapidly, but it can also be corrected just as quickly.

Key recommendations for 2026:

- buy metal only from trusted banks or certified dealers;

- Follow the news on silver shortage and green energy development;

- Do not concentrate all your capital in one asset;

- Consider silver as part of a portfolio (approximately 10-20%), not a single bet.

Source: Fortune

Recommended:

How to buy cryptocurrency

Bitcoin price forecast to $100,000

Changpeng Zhao's wealth increased by $3 billion during his imprisonment...

Why the US Federal Reserve rate decides the fate of Bitcoin and altcoins...

SWIFT changes the rules of the game: what awaits cryptocurrencies...

Revenues from Ethereum staking fell by 42% in half a ...

What is Ethena Finance? The essence of the synthetic dollar U...

The Hamster Kombat team has announced that the second season of ...

In 4 years, the largest inflow of institutional...

Ripple CEO predicts a reboot of the crypto industry...

The US Treasury wants to reduce the market of private equity...

Bitcoin has updated its historical maximum after the decision of the F...

Bitcoin rate soars: US authorities will buy up to 5% of B...

Europe cradles the Bitcoin rate: the pension fund of the Great...

Analyst Michael van de Popp predicts Bitcoin will reach $100...

Will Trump's victory affect Bitcoin's price?

Analyzing pumps in the cryptocurrency market

Ethereum ecosystem: preparing for a new breakthrough

Solana vs. Ethereum: who will win in the fight for De...

Cryptocurrency trends in 2024: what to look for...

CBDC: how digital currencies of central banks will change...

Bitcoin Jesus scandal: what happened to Roger...

Development of the cryptocurrency industry in Ukraine

$

USD₴

UAH

+38 (067) 450 40 40

+38 (067) 450 40 40