Tether buys 27 tons of gold

Tether, the issuer of the world's largest stablecoin USDT, has announced the purchase of 27 tons of physical goldin the fourth quarter of 2025. In this way, the company continues its strategy of diversifying reserves, gradually reducing its dependence solely on government bonds and cash.

According to the company, the gold is stored in specialized vaults and is part of the asset structure that ensures the stability of USDT. This is one of Tether's biggest steps towards real, non-fiat assets since the project's inception.

Why gold is the logical choice for Tether

In the global context gold purchase seems to be a logical extension of the strategy to protect against financial and regulatory risks. Gold is traditionally considered a safe-haven asset in times of financial instability, inflationary pressures and rising debt risks.

For Tether, this means:

- increasing confidence in the reserves on the part of institutional players;

- reducing regulatory risks associated with fiat assets;

- additional insurance against turbulence in the government bond markets.

Amid active discussions about the transparency of stablecoin reserves, betting on physical gold looks like a pragmatic financial solution.

A paradigm shift in the stablecoin market

This deal shows that the stablecoin market is gradually changing. Such assets are no longer viewed as just a "digital version of the dollar," but increasingly combine fiat funds, debt instruments, and real assets, such as gold.

When the largest player in the market consistently increases the share of gold in reserves, it sets the direction for the entire industry. Other issuers will either have to move in the same direction or explain to investors and regulators why their collateral models are no less reliable. In the long run, this may change the very idea of what a truly stable digital asset should be.

What this means for investors and users of USDT

For ordinary USDT users, buying gold does not directly change the mechanics of the stablecoin, but changes the context of trust. Reserves backed by a physical asset with a long history of preserving value reduce systemic risks in the face of global financial tensions.

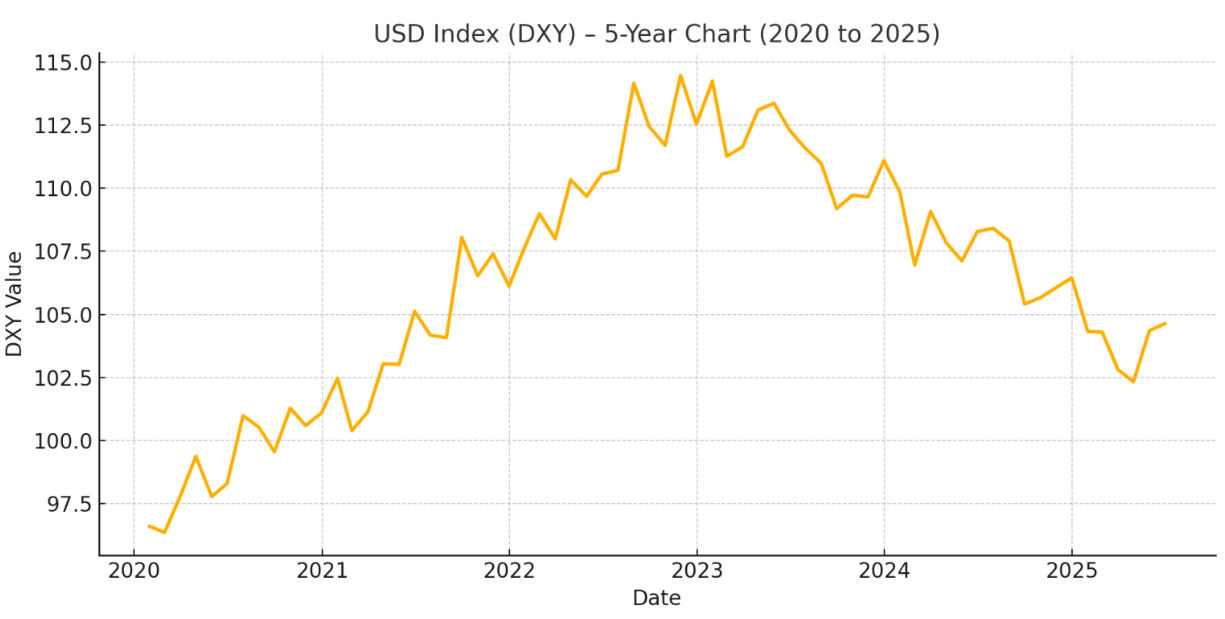

From an investment perspective, this is also a signal that major crypto players are taking scenarios of prolonged fiat currency instability more and more seriously. In other words, gold is not returning as an alternative to the crypto market, but as its fundamental element of protection.

In the event of financial crises or problems with traditional currencies, USDT has an additional "safety margin" that makes it less vulnerable to sudden shocks and increases user confidence.

Source: Reuters

Recommended:

How to buy cryptocurrency

Bitcoin price forecast to $100,000

Changpeng Zhao's wealth increased by $3 billion during his imprisonment...

Why the US Federal Reserve rate decides the fate of Bitcoin and altcoins...

SWIFT changes the rules of the game: what awaits cryptocurrencies...

Revenues from Ethereum staking fell by 42% in half a ...

What is Ethena Finance? The essence of the synthetic dollar U...

The Hamster Kombat team has announced that the second season of ...

In 4 years, the largest inflow of institutional...

Ripple CEO predicts a reboot of the crypto industry...

The US Treasury wants to reduce the market of private equity...

Bitcoin has updated its historical maximum after the decision of the F...

Bitcoin rate soars: US authorities will buy up to 5% of B...

Europe cradles the Bitcoin rate: the pension fund of the Great...

Analyst Michael van de Popp predicts Bitcoin will reach $100...

Will Trump's victory affect Bitcoin's price?

Analyzing pumps in the cryptocurrency market

Ethereum ecosystem: preparing for a new breakthrough

Solana vs. Ethereum: who will win in the fight for De...

Cryptocurrency trends in 2024: what to look for...

CBDC: how digital currencies of central banks will change...

Bitcoin Jesus scandal: what happened to Roger...

Development of the cryptocurrency industry in Ukraine

$

USD₴

UAH

+38 (067) 450 40 40

+38 (067) 450 40 40