Gold has reached $4600: why precious metals are setting new records in 2026

In January 2026, gold crossed $4600,{{2}} per troy ounce for the first time in history. Silver has updated its all-time high, while platinum and palladium are also showing rapid growth. This boom is attributed to a combination of geopolitical risks, political pressure on the Fed, and investors' search for safe-haven assets in times of uncertainty.

Record prices in the precious metals market

As of January 12, 2026, the price of gold approached $4600 per ounce, setting a new all-time high. Silver rose to over $84, while platinum and palladium also showed strong growth, supporting the overall upward trend in the precious metals market.

Such indicators make precious metals the most attractive safe assets in the current environment. Investors are flocking to gold and silver as traditional stock and bond markets become vulnerable.

The main reasons for the growth: weak dollar and Fed rates

The weakness of the US dollar was a key catalyst. Political pressure on Fed Chairman Jerome Powell by the Trump administration has triggered expectations of an imminent rate cut. The investigation against Powell is perceived as an attempt to force the regulator to ease monetary policy.

Low rates reduce the attractiveness of non-interest-bearing dollar assets, so capital flows into gold. Goldman Sachs analysts have already postponed the projected rate cut until June-September 2026.

Geopolitical risks increase demand for gold

Aggressive US foreign policy is adding to the tension. Discussions about the annexation of Greenland, the change of power in Venezuela, and threats of strikes against Iran create an atmosphere of uncertainty.

In this environment, investors are withdrawing capital from assets dependent on political decisions and currencies and transferring it to gold as a neutral hedge.

Amid record prices, some investors are considering buy gold bullion as a physical way of preserving capital from currency and stock market risks.

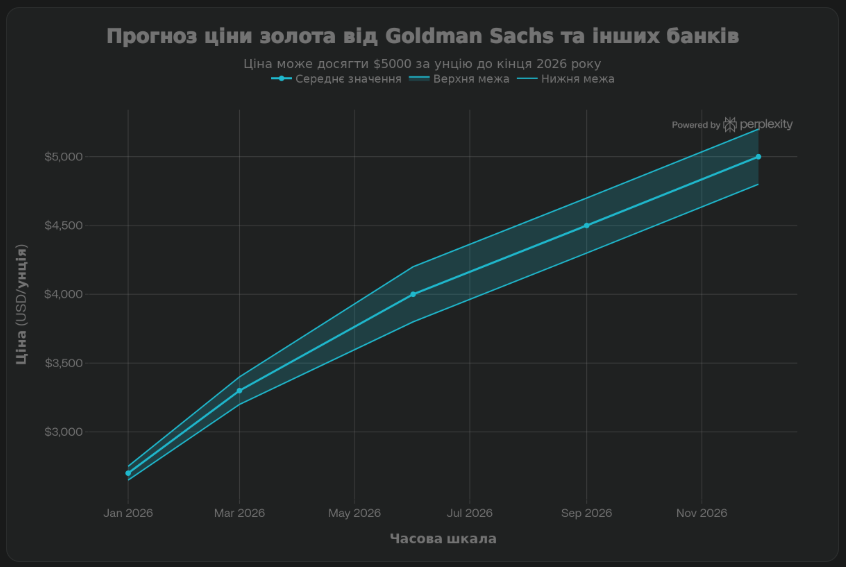

Analysts' forecasts: will growth continue

Most experts expect further growth. ANZ forecasts silver at $90 per ounce due to restrictions from China. Goldman Sachs and other banks see gold in the range of $4800-5200 by the end of 2026. Some forecasts, such as from Yardeni Research, reach $6000.

If geopolitical tensions do not ease and the dollar remains weak, prices could set new records on a quarterly basis.

A new reality for security assets

The precious metals market's record in 2026 reflects a shift in global sentiment and increased investor caution. Gold, silver, platinum, and palladium are back in the spotlight as assets that can preserve value in times of volatility.

In the absence of clear signals of easing tensions on the global stage and amid a weak dollar, precious metals remain one of the key benchmarks for financial markets.

Source: Ministry of Finance

Recommended:

How to buy cryptocurrency

Bitcoin price forecast to $100,000

Changpeng Zhao's wealth increased by $3 billion during his imprisonment...

Why the US Federal Reserve rate decides the fate of Bitcoin and altcoins...

SWIFT changes the rules of the game: what awaits cryptocurrencies...

Revenues from Ethereum staking fell by 42% in half a ...

What is Ethena Finance? The essence of the synthetic dollar U...

The Hamster Kombat team has announced that the second season of ...

In 4 years, the largest inflow of institutional...

Ripple CEO predicts a reboot of the crypto industry...

The US Treasury wants to reduce the market of private equity...

Bitcoin has updated its historical maximum after the decision of the F...

Bitcoin rate soars: US authorities will buy up to 5% of B...

Europe cradles the Bitcoin rate: the pension fund of the Great...

Analyst Michael van de Popp predicts Bitcoin will reach $100...

Will Trump's victory affect Bitcoin's price?

Analyzing pumps in the cryptocurrency market

Ethereum ecosystem: preparing for a new breakthrough

Solana vs. Ethereum: who will win in the fight for De...

Cryptocurrency trends in 2024: what to look for...

CBDC: how digital currencies of central banks will change...

Bitcoin Jesus scandal: what happened to Roger...

Development of the cryptocurrency industry in Ukraine

$

USD₴

UAH

+38 (067) 450 40 40

+38 (067) 450 40 40