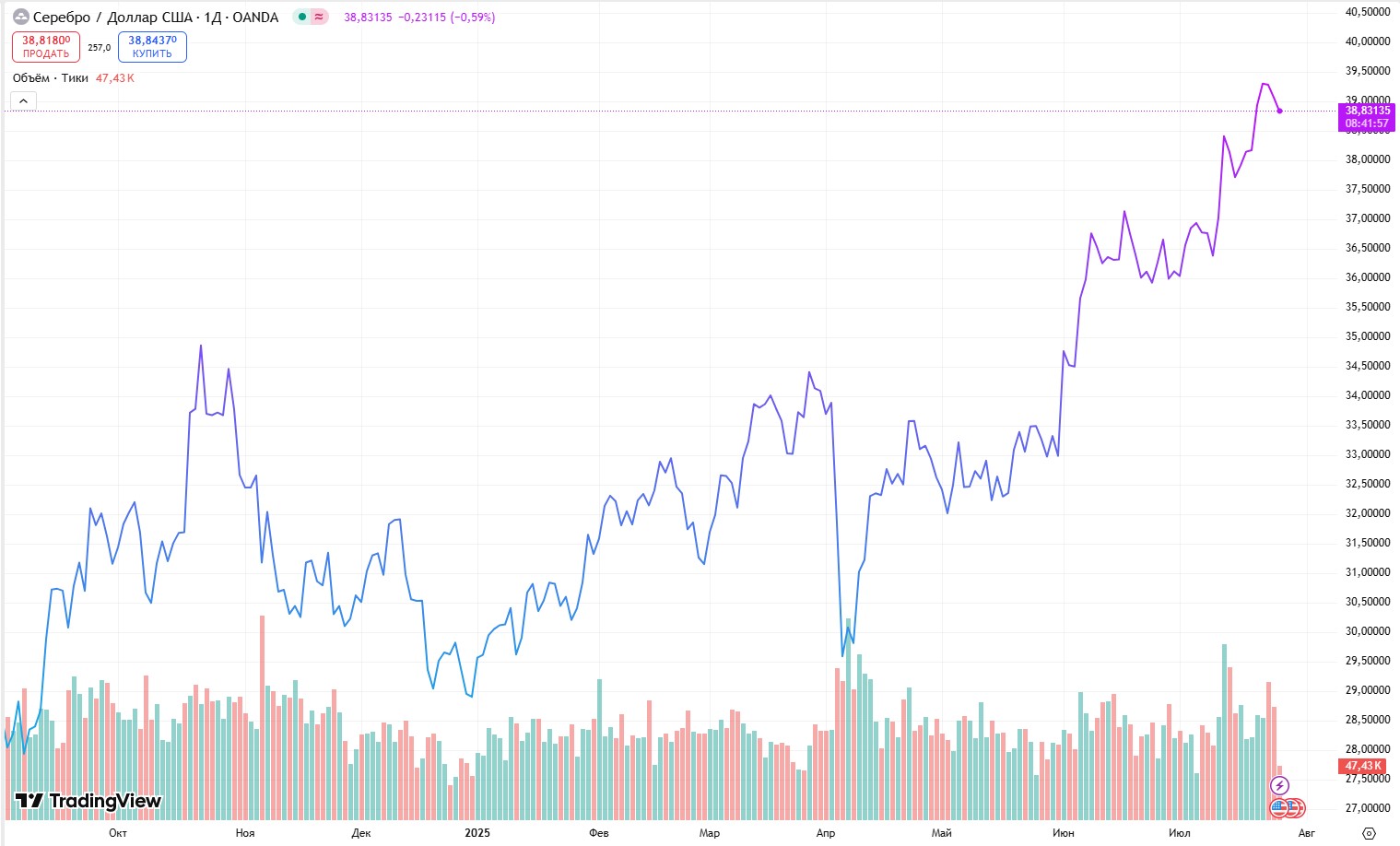

Silver is rising rapidly: the highest since 2011

July 23, 2025 - Silver prices have reached a record high over the past 14 years, making the metal an attractive asset for investors and exchange office clients. The rise in prices has been driven by fears of new US tariffs, market shortages, and increased demand for silver as an alternative to gold.

Spot silver rose by 0.3% to $39.40 per troy ounce, the highest since September 2011. Since the beginning of 2025, silver has risen in price by 36%, outperforming gold with its 31% rise. Experts predict that the price could reach $42 per ounce this year.

Why is silver rising in price?

US tariffs: President Donald Trump's plans to impose 1% duties on copper imports and tariffs on goods from Mexico on August 50 increased the premium on US silver futures. This led to an increase in rental rates on the spot market.

Deficit in the market: The silver market is heading for its fifth year of structural deficit. Industrial demand remains strong, especially in the electronics and solar energy sectors.

Investment interest: Silver, as a more affordable precious metal, is attracting investors looking for an alternative to gold. The gold-to-silver ratio improved to 87 ounces of silver per ounce of gold, the best level in seven months.

What does this mean for investors?

Rising silver prices open up new opportunities for investment and exchange. Silver is traditionally considered a reliable asset in times of economic instability. You can buy silver at favorable rates on the page silver purchases.

Experts predict that in the short term, the price of silver may exceed $40 per ounce, but a temporary pullback to $35 is possible before growth continues to $45 in 2026. This makes silver attractive for long-term investment.

Recommended:

How to buy cryptocurrency

Bitcoin price forecast to $100,000

Changpeng Zhao's wealth increased by $3 billion during his imprisonment...

Why the US Federal Reserve rate decides the fate of Bitcoin and altcoins...

SWIFT changes the rules of the game: what awaits cryptocurrencies...

Revenues from Ethereum staking fell by 42% in half a ...

What is Ethena Finance? The essence of the synthetic dollar U...

The Hamster Kombat team has announced that the second season of ...

In 4 years, the largest inflow of institutional...

Ripple CEO predicts a reboot of the crypto industry...

The US Treasury wants to reduce the market of private equity...

Bitcoin has updated its historical maximum after the decision of the F...

Bitcoin rate soars: US authorities will buy up to 5% of B...

Europe cradles the Bitcoin rate: the pension fund of the Great...

Analyst Michael van de Popp predicts Bitcoin will reach $100...

Will Trump's victory affect Bitcoin's price?

Analyzing pumps in the cryptocurrency market

Ethereum ecosystem: preparing for a new breakthrough

Solana vs. Ethereum: who will win in the fight for De...

Cryptocurrency trends in 2024: what to look for...

CBDC: how digital currencies of central banks will change...

Bitcoin Jesus scandal: what happened to Roger...

Development of the cryptocurrency industry in Ukraine

$

USD₴

UAH

+38 (067) 450 40 40

+38 (067) 450 40 40